|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How Should I Refinance My House: A Comprehensive GuideRefinancing your house can be a strategic financial move. It may lower your monthly payments, reduce your interest rate, or even help you access equity. However, understanding the process and determining the right time to refinance are crucial steps. Understanding RefinancingWhat is Refinancing?Refinancing involves replacing your existing mortgage with a new one, often with better terms. This can lead to substantial savings over time. Why Refinance?

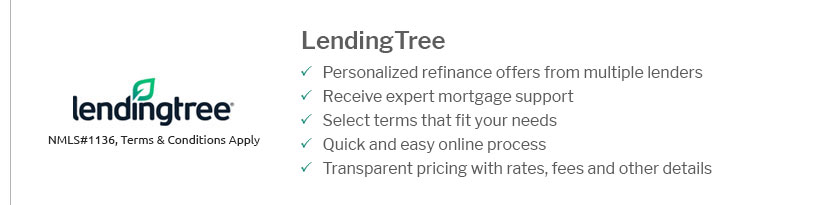

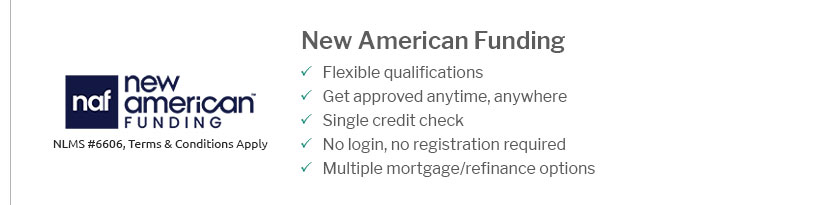

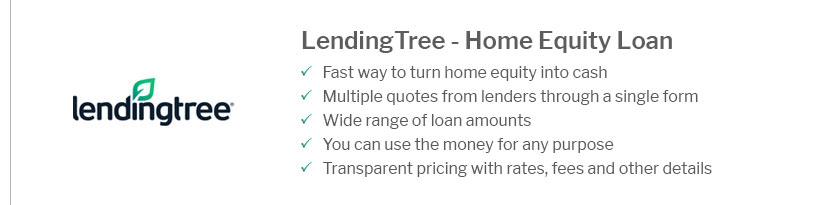

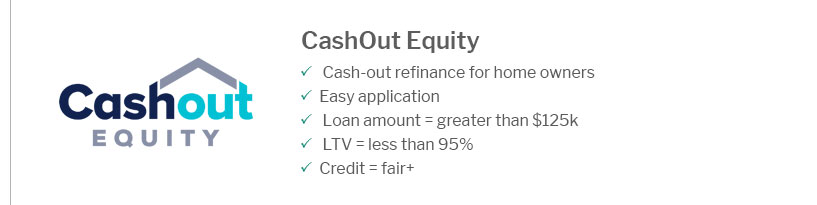

Steps to Refinance Your HouseEvaluate Your Financial SituationReview your credit score, income, and current mortgage details. This will help you determine your refinancing eligibility. Shop Around for LendersCompare offers from different lenders to find the best rates and terms. You can also explore whether you can refinance with the same lender, which might offer added conveniences. Choose the Right TimeTiming is crucial. Assess market conditions to ensure you're refinancing at the best time to refinance home for maximum benefits. FAQs on RefinancingHow often can I refinance my house?There is no legal limit to how often you can refinance, but consider the costs and benefits carefully each time. What are the costs associated with refinancing?Refinancing costs can include application fees, appraisal fees, and closing costs, typically ranging from 2% to 5% of the loan amount. Is refinancing a good idea if I plan to move soon?If you plan to move soon, refinancing may not be cost-effective due to the upfront costs unless you significantly lower your interest rate. https://www.youtube.com/watch?v=EzOzwmFvIh4

Before you refinance and have HUGE regrets, make sure you avoid these crucial mistakes. What things do you need to consider when refinancing ... https://www.bankrate.com/mortgages/when-to-refinance/

Refinancing your mortgage could make sense for several reasons: lowering your interest rate, taking cash out or switching to a fixed-rate loan. https://www.rocketmortgage.com/learn/should-i-refinance

When To Refinance A Mortgage - When Interest Rates Are Low - When Your Credit Score Increases - When You Need To Add Or Remove A Borrower - When ...

|

|---|